8 10 Conversion Costs Financial and Managerial Accounting

The manufacturing sector analyses both prime costs and conversion costs to measure efficiency in the production of a product. Conversion costs only include direct labor and manufacturing overheads because of the reason that these two variables are rudimentary to execute the overall process. The cost of a product is determined by the amount of labor conversion cost formula and overhead needed to convert raw materials into finished goods. Calculating conversion costs is crucial for businesses to manage production expenses, set competitive prices, and make informed decisions about scaling production or optimizing efficiency. Consider a professional furniture maker who is hired to make a coffee table for a customer.

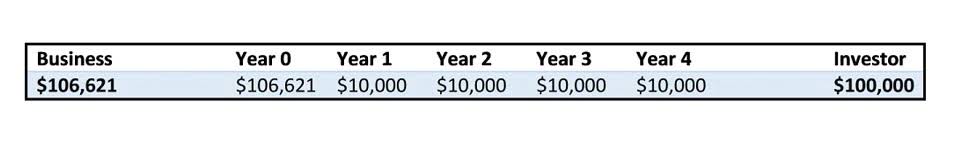

Example Calculation

One can arrive at total period costs by closely monitoring and reporting the expenses that aren’t related to manufacturing a product. The conversion costs would also help in calculating the cost of goods sold (COGS) accurately. As can be seen from the list, the bulk of all conversion costs are likely to be in the manufacturing overhead classification. From a company’s perspective, the lower the conversion cost, the higher the profit margins. Therefore, in order to achieve optimization of the production process, companies strive to keep the conversion costs minimum.

Prime Costs Vs. Conversion Costs – What are the Key Difference?

Prime costs are calculated based on the direct labour costs and the total cost of the raw materials. In contrast, conversion costs are focused on the direct labour costs and the costs involved in the indirect factors which affect the manufacturing and production system like electricity, factory insurance, etc. Conversion costs include the direct labor and overhead expenses incurred as raw materials are transformed into finished products.

How to Calculate Beginning Inventory & Conversion Costs

Conversion cost is one of the most basic accounting tasks in almost all the major business sectors. Conversion costs reflect a company’s total amount spent converting raw materials into fully-furbished products. It includes the direct labour costs and the amount spent https://www.bookstime.com/ on indirect factors like electricity bills, factory rent, etc., which cannot be directly traced down to the production of a single unit. Conversion costs are beneficial, especially for manufacturing businesses which have to deal with conversion on a large scale daily.

- The expenses involved in this transformation are known as the conversion cost of a product.

- For this reason, it’s a more relevant number for operations managers, who may be looking at ways to reduce the indirect expenses of production.

- Conversion costs are the costs that are incurred by manufacturing companies when converting raw materials into finished goods.

- For shipping the raw materials to the desired location, they paid ₹30,000 to the transportation company.

- Direct materials is the basic physical ingredient, matter or substance which the company processes to make a salable product.

- Beginning inventory does not appear in the balance sheet as organizations prepare financial statements at the end of the accounting period.

Examples of Conversion Costs

Each department tracks its conversion costs in order to determine the quantity and cost per unit (see TBD; we discuss this concept in more detail later). Conversion costs are restricted to direct labor and manufacturing overhead, which are needed to convert raw materials into completed products. Prime costs are the direct labor and direct materials costs incurred to build a product. In simpler terms, direct labor costs are the payments to the workers doing the hands-on work, while manufacturing overhead costs are the behind-the-scenes expenses that keep the entire production process going. Both are essential components of conversion costs, giving a complete picture of the money spent to transform raw materials into finished products.

Which Costs Are Both Prime and Conversion Costs?

- Overhead costs are expenses that cannot be directly attributed to the production process but are necessary for operations, such as the electricity required to keep a manufacturing plant functioning throughout the day.

- Tangible components—such as raw materials—that are needed to create a finished product are included in direct materials.

- They are referred to as the manufacturer’s production related cost, which does not include the costs incurred in production of direct materials.

- By accurately calculating and managing these costs, companies can identify opportunities for improvement and make informed decisions about pricing, production, and process enhancements.

- The use of this ratio in process costing is to calculate the cost for both direct labor and manufacturing overheads.

- Consider a professional furniture maker who is hired to make a coffee table for a customer.

- Direct labor costs are the wages paid to the employees engaged in manufacturing a product or provision of service.

- A company’s accounts managers and production managers calculate these conversion costs to estimate the production expenses, and the value of the finished and unfinished inventory, and make product-pricing models.

- Direct labor costs are the wages and salaries paid to employees who are directly involved in the production process.

- Other examples of manufacturing overheads are electricity costs, insurance costs and maintenance costs.

- As reported in Corporate Finance Institute, period costs are the expenses that aren’t incurred by manufacturing a product.

- Bruce is trying to figure out what his conversion costs are for the quarter in order to estimate his finished inventory for the interim financial statements.